Just like most people my age, I am learning how to be a grown-up. It is not easy and I am far from having it all figured out. Living by a monthly budget has been a daunting grown-up goal of mine for as long as I can remember and after putting it off for the two years I worked before we were married (and being haunted by my W-2s that show me the money I made and of could have saved), I am determined not to allow that blind state of mind into the new life that Ryan and I are building together. We are hoping to have a home of our own one day so making a plan now is crucial.

(Wedding pic to show budgeting? Whatever…I’ll use any excuse to relive that day. Here are more wedding pics in case you missed them hehe.)

My father in law gave my husband a printed out copy of Kiplinger’s Starting Out Guide to Your Money: How Millennials Can Get Ahead and I have stolen it and made it my mission to intact a lot of what it says. Of course you can read it on your own but I am going to share with you what I really took from the article (full disclosure, I am far from a financial wiz):

1. Have an emergency fund. Gone are the days when we can call our parents when the car’s transmission blows or the laptop crashes. Prepare yourself for that sort of thing because it will happen when you least expect it.

2. Investing is a good idea. We are already do the 401K thing (a must), so I am talking beyond that. According to Keplinger, if you save $100 a month in a savings account with .95% interest, you’ll have $58,400 in 40 years BUT if you invest the same amount with an 8% annual return then you’ll have $324,180 after 40 years. Woah.

3. Don’t over stress about student loans. Most of us have them. Mine gives me a stomach ache every time I look at it because I feel like most of what I know came from real world experience and college was a right of passage (but thats a soap box for another day). Of course make payments towards it but make your emergency fund and retirement savings a priority too.

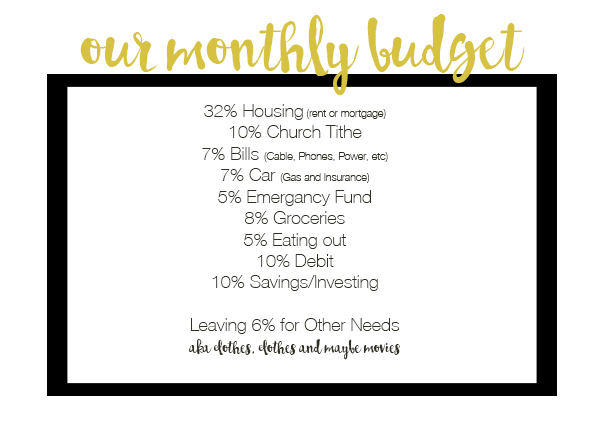

And now the budget to help you do all that…

Kiplinger has its own budget here, but this is what we are going for based on paychecks after money has already been allocated to the 401K:

Of course I am joking about the “other needs” but make sure to leave room for unexpected costs 😉

What grown-up tips have you mastered? I need all the help I can get!